When it comes to securing your family's well-being, picking the right life insurance arrangement is vital. North Carolina provides a wide range of possibilities to fulfill your unique needs. Whether are looking for term life insurance, a insurance expert can assist you navigate the details and discover the perfect match for your needs.

- Consider your family's financial goals

- Explore different types of life insurance plans

- Speak to a licensed financial advisor in North Carolina

Final Expense Coverage

Life is full of surprises, and sometimes those surprises can come with unexpected costs. Medical bills, funeral expenses, or even outstanding debts can create a financial burden for your loved ones here during an already difficult time. That's where NC Final Expense insurance comes in. This type of coverage provides you with a lump sum payment for help cover these final costs, ensuring that your family is supported. By purchasing NC Final Expense, you can give your loved ones the opportunity of financial freedom during a challenging period.

Insurance Coverage in North Carolina

Finding affordable life insurance for North Carolina is a important step toward securing your family's financial future. With a variety of choices available, you can find coverage that meets your budget. It's important to research different policies and companies to ensure you get the best value. Consider factors like coverage, term length, and your overall budgetary constraints.

Don't hesitate to consult a licensed insurance advisor who can help you understand the available options to find the most affordable life insurance plan.

Finding the Right Life Insurance Policy in NC

Finding the right life insurance policy in North Carolina can be a challenging process. With so many different plans available, it's important to thoroughly consider your desires.

A good life insurance policy should provide financial protection for your loved ones in the event of your passing. It's crucial to choose a policy that delivers the right amount of protection at a fair price.

To determine the best life insurance policy for you, it's advised that you shop around different insurers and policies. Don't hesitate to inquire from a licensed insurance agent to ensure you understand the details of any policy before you agree to it.

Securing Your Loved Ones After You're Gone: NC Life Insurance Options

Life is full of uncertainties, however one thing remains constant: the love we have for our dear ones. When you pass away, it's crucial to ensure that your those closest to you are well-provided for. This is where life insurance in North Carolina steps in.

A death benefit plan can supply a lump sum of money to your beneficiaries when you depart this world . This fund can be used to address a wide range of obligations, such as loan repayment, funeral arrangements, and basic needs.

There are diverse types of life insurance options to choose from in North Carolina, each with its own features. Explore your needs carefully to choose the policy that best fits your situation.

Obtain Your Future with a Free NC Life Insurance Quote Today

Are you seeking the best way to secure your loved ones? Don't wait until it's past. Get a complimentary quote on NC Life Insurance today and discover how much financial security you can acquire. Our knowledgeable agents will guide you in finding the suitable policy to address your unique needs. Begin your journey toward financial protection by requesting a quote today!

- Get an instant online quote.

- Compare multiple policies from top insurers.

- Converse with a licensed agent for customized advice.

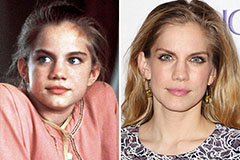

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now!